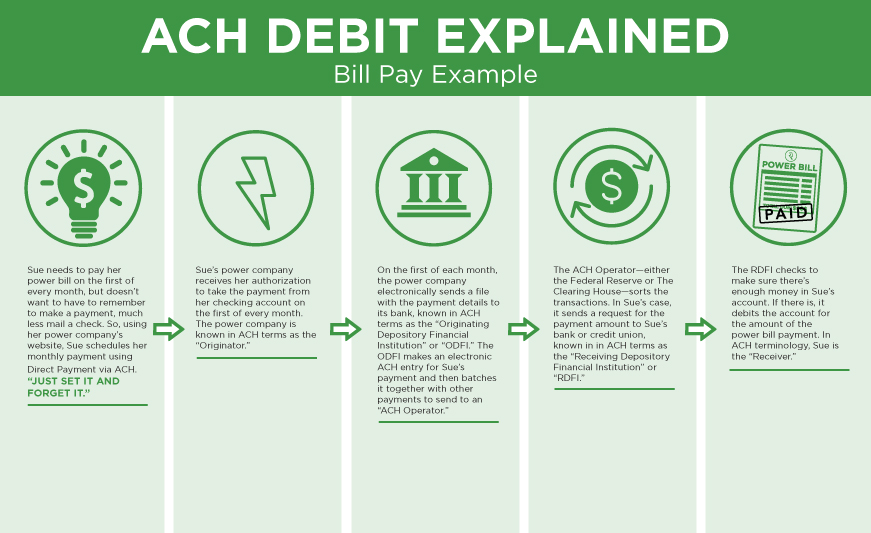

An automated clearing house ach is a computer based electronic network for processing transactions usually domestic low value payments between participating financial institutions it may support both credit transfers and direct debits.

Clearing house automated payment system advantages.

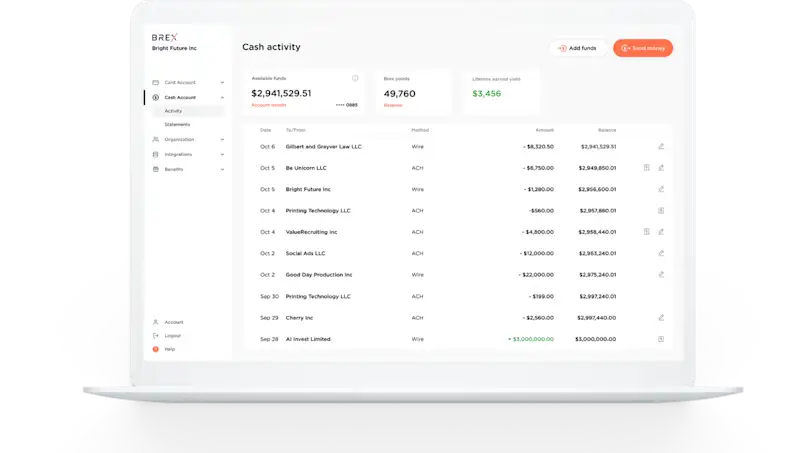

Minimize paper records that carry sensitive banking information.

Get paid faster with an automated payment and without waiting for a check to clear.

By 2015 it was settling well over us 1 5 trillion a day in around 250 000 interbank payments in cross border and domestic transactions.

The automated clearing house ach is the primary system that agencies use for electronic funds transfer eft with ach funds are electronically deposited in financial institutions and payments are made online.

What is chaps clearing house automated payment system.

Automated clearing house is a system for financial transactions in the u s.

Together with the fedwire funds service which is operated by the federal reserve banks chips forms the primary u s.

The clearing house automated payments system chaps is a u k based system that facilitates large british pound denominated money transfers.

Find out when to use the ach network and the benefits of the payment system.

The acronym chaps stands for clearing house automated payments and refers to automated bank to bank payments that are made on the same day.

The clearing house interbank payments system chips is a united states private clearing house for large value transactions.

More transit item definition.

Responsibility for the chaps system transferred to the bank of england in november 2017.

Multinational banks principally use chaps.

Chaps is typically used for high value urgent payments such as those transferred by a solicitor between banks and current accounts during a house purchase.

The ach system is designed to process batches of payments containing numerous transactions and charges fees low enough to encourage its use for low value.

Automating bill payments to avoid late fees and missed payments.

The automated clearing house network ach is an electronic funds transfer system run by nacha formerly the national automated clearing house association.

Making online purchases without having to use a credit card or check.

Obviously a key benefit of using this payment method is the speed at which the money is transferred and cleared but is there more to understand.

Chaps is one of the largest high value payment systems in the world providing efficient settlement risk free and irrevocable payments.

:max_bytes(150000):strip_icc()/what-does-ach-stand-for-315226_FINAL-a68079317cfb403aaa73cab72e1762ab.png)