About form 4255 recapture of investment credit about form 8453 u s.

Commercial solar investment tax credit 2017.

Owners of new residential and commercial solar can deduct.

Since the 1970s the federal government has given out a 10 percent tax credit to non oil and gas energy investments including solar.

Through the end of 2019 your organization can claim 30 of the installation costs as a tax credit.

Economy in the.

The itc applies to both residential and commercial systems and there is no cap on its value.

In 2006 the tax relief and health care act p l.

Here are the specifics.

These two guides one for homeowners and one on the commercial itc provide a concise yet thorough overview of the itc demystifying the tax code with intuitive explanations and examples answering frequently asked questions and explaining the process of claiming the itc.

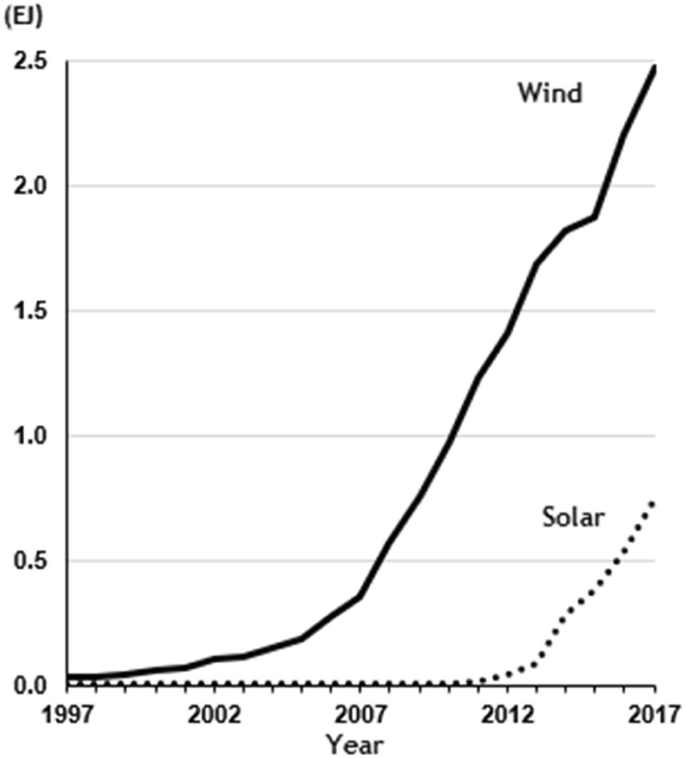

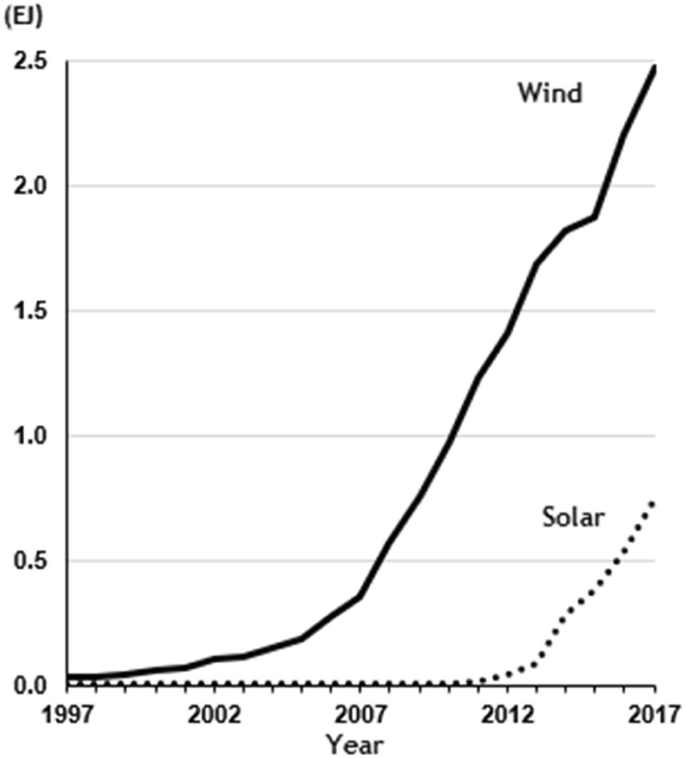

Solar industry has grown by more than 10 000 creating hundreds of thousands of jobs and investing billions of dollars in the u s.

Since the itc was enacted in 2006 the u s.

109 58 created a 30 percent itc for residential and commercial solar energy systems that applied to projects placed in service between january 1 2006 and december 31 2007.

If you file a form 1040 or 1040 sr schedule c you may be eligible to claim the earned income tax credit eitc.

The solar investment tax credit itc is one of the most important federal policy mechanisms to support the growth of solar energy in the united states.

Commercial and industrial property owners are eligible for a generous federal tax credit program.

Solar investment tax credit itc 101 the energy policy act of 2005 p l.

In addition to the credit form in most cases you may also need to file form 3800.

The tax credit remains at 30 percent of the cost of the system.

Now the solar investment tax credit is available to homeowners in some form through 2021.

This guide provides an overview of the federal investment.

The 30 federal investment tax credit itc is among the most important incentives currently available for solar pv.

Investment tax credit for commercial solar photovoltaics disclaimer.

Individual income tax transmittal for an irs e file return page last reviewed or updated.

This investment tax credit program was always intended to be.

2012 and december 31 2017 can elect to claim a 50 depreciation bonus.

In 2020 you ll be able to deduct 26 of the cost of the system from your taxes.